Uncategorized

Economy: High spirits

admin | August 17, 2018

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors.

The U.S. economy has accelerated over the past year or so to a real growth rate of almost 3% on average while the unemployment rate has dropped below 4%. Various measures of consumer and business confidence indicate that animal spirits are very high, with consumers and business executives displaying unusually strong optimism about the economy. That bodes well for the willingness of both consumers and businesses to spend.

Consumer confidence

Financial market participants follow several measures of consumer attitudes as a proxy for the likely behavior of consumer spending. While the day-to-day and month-to-month relationship between attitudes and spending is loose, the various gauges of consumer optimism do provide some insight into the general state of household income and spending patterns.

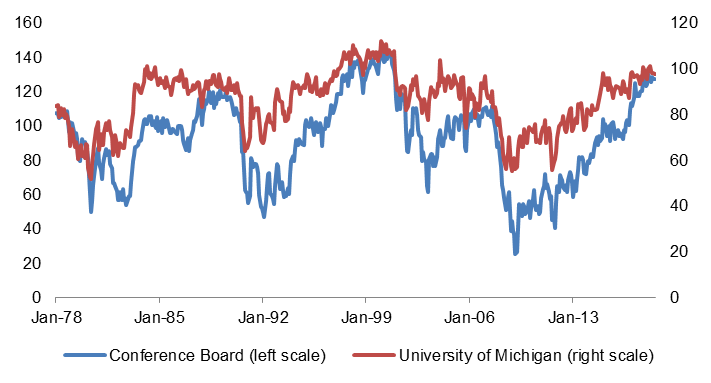

The two most prominent measures of household optimism are the Conference Board and University of Michigan indices. Aside from an outlier spike in the University of Michigan measure in January 2004, each of these has reached levels this year not seen since 2000 (Exhibit 1). In fact, for both series, the string of readings so far this year is about as high as any in the history of either series with the exception of the euphoria seen in the late 1990s and 2000.

Exhibit 1: Conference Board and University of Michigan consumer confidence

Source: Conference Board, University of Michigan.

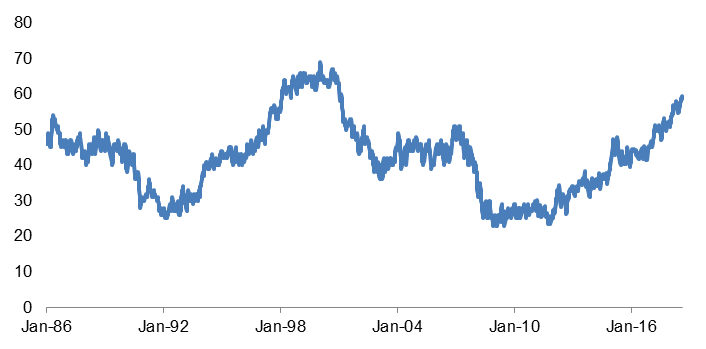

Bloomberg publishes two related gauges of consumer attitudes. The weekly index of consumer comfort has an extensive history and is released at a higher frequency than the more-prominent monthly gauges. The Bloomberg measure has reached levels in recent weeks not seen since early 2001 (Exhibit 2).

Exhibit 2: Bloomberg weekly consumer comfort index

Source: Bloomberg.

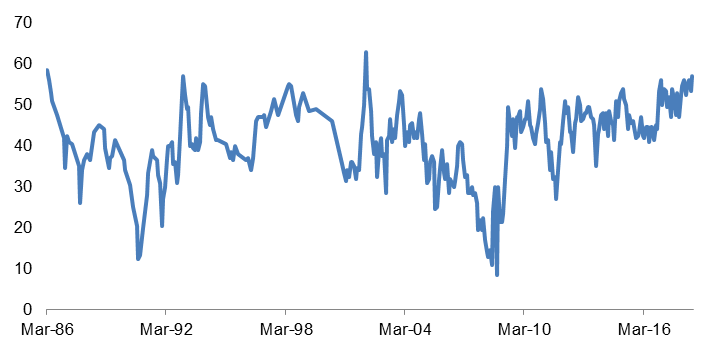

In conjunction with the weekly consumer comfort index, Bloomberg also publishes a monthly measure of economic expectations, a more forward-looking alternative. The most recent reading of this gauge jumped to the highest level since 2002 and the second-highest level since 1986 (Exhibit 3).

Exhibit 3: Bloomberg index of economic expectations

Source: Bloomberg

These indices offer a convincing case that consumers are as optimistic as they have been in a long time. This should not come as a surprise. A stellar job market is generating solid income gains, balance sheets are broadly in good shape, and most households are enjoying a tax cut since early in the year.

Business confidence

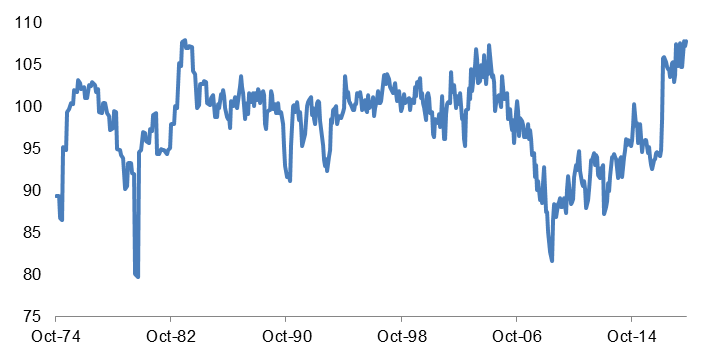

Surveys of business confidence are not usually as widely followed by market participants, but they suggest that executives are also largely upbeat. The NFIB small business optimism gauge reports attitudes of small businesses (defined as 50 employees or less, though the majority of respondents run firms employing 10 or less). It jumped in July to 107.9, the highest reading since 1983 and within a tenth of a point of the all-time high going back to 1974 (Exhibit 4).

Exhibit 4: NFIB small business optimism index

Source: National Federation of Independent Business

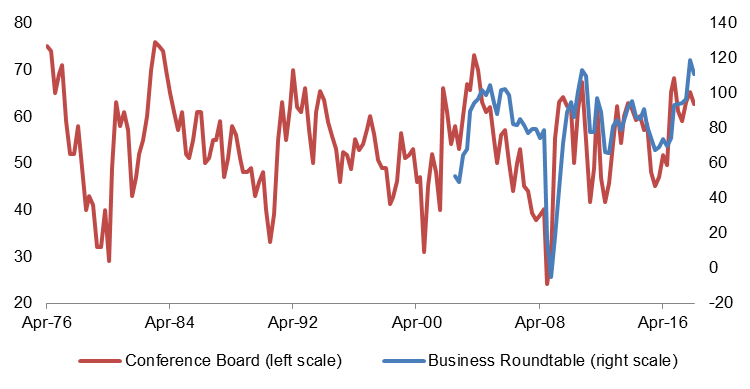

Meanwhile, there are several gauges of optimism among executives at larger businesses (Exhibit 5). The Business Roundtable CEO gauge established a new high in the first quarter of this year, though the history of the measure only goes back to 2002. The Conference Board CEO gauge is somewhat more restrained, but it should be noted that the Conference Board is designed to measure CEOs’ perceptions of changes in activity rather than levels (note that in past cycles, the gauge tended to peak at the beginning of the recovery, not 9 years into the expansion, as we are now).

Exhibit 5: CEO optimism indices

Source: Conference Board, Business Roundtable.

There are two details worth pointing out with respect to business confidence. First, the CEO gauges both cooled in the second quarter after surging in Q1. I suspect that the jump at the beginning of the year reflected optimism in the aftermath of the tax cut, while the somewhat more cautious view in the spring was likely caused by concerns regarding potential tariffs and/or a trade war. The second observation is that CEOs were clearly more worried about the international trade situation than small business owners, a logical contrast since most large corporations operate globally while many small businesses are exclusively domestic. In any case, business executives remain largely upbeat, which bodes well for plans to add workers and/or engage in new investment projects.