Uncategorized

Volatility drives restructuring of Freddie Mac K-series, capital rules can continue it

admin | June 12, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors.

Market volatility during March and April caused substantial spread widening in agency CMBS, temporarily making it uneconomic for Freddie to issue mezzanine tranches in K-series deals. Spreads on guaranteed classes have since tightened, and new issues are printing close to pre-pandemic levels. However, the FHFA’s proposed new capital rules, published at the end of May, would dramatically lower the capital relief available for credit risk transfer via securitization. The new rules appear to have prompted Freddie Mac to suspend issuing mezzanine classes on an interim basis for new K-series deals. Lower capital relief afforded under the proposed rules has made it more attractive to raise guarantee fees on underlying loans and wrap a larger share of each K deal. If the proposed rules become final, it is likely that K-series investors would see permanently larger AM classes in the future and an end to unguaranteed B and C classes.

First passes on mezz

Among the first K-series deals that were issued without the typical B and C mezzanine tranches were the KF77 and K107 deals which priced on April 2nd and April 15th, respectively. The spreads on B and C classes, which were typically issued in the range of 150 bp and 200 bp over swaps, respectively, were trading in the range of 375 bp and 525 bp in early April, down from higher altitudes they touched in March. Freddie passed on issuing mezzanine classes in these deals in favor of raising the guarantee fee and wrapping that collateral into the AM class. These initial skips on issuing mezzanine debt, and the role that Fed buying of agency CMBS played in settling markets and tightening spreads, was discussed in the Amherst Portfolio Strategy piece, Lessons from the Fed’s agency CMBS operations, of 4/17/2020.

The re-proposed capital rule

The FHFA recently proposed a new regulatory capital framework for Fannie Mae and Freddie Mac that, if adopted, will substantially increase the total capital required by the Enterprises. Included is an aggressive reduction in the amount of capital relief provided by credit risk transfer transactions that have long been established by the FHFA as one of the primary objectives for the GSEs. The credit risk transfer accomplished through the traditional K-series securitization structure is particularly penalized.

The newly proposed capital framework—often referred to as the 2020 proposed rule in FHFA documentation—is actually a re-working of the 2018 proposal for new risk-based capital requirements, which was published but never adopted. The new FHFA director and the current administration has stated their intention to end the conservatorships of the Enterprises, and the re-worked regulatory capital framework supports that goal.

The complete capital rule is 424 pages, but the FHFA has also published a 16-page fact sheet summarizing the main changes and updates incorporated in the new proposal, and how it compares to the 2018 proposal. The capital requirement for the Enterprises combined rises from $137 billion under the 2018 proposal to $234 billion under the current proposal (Exhibit 1). Most of the additional $100 billion comes from newly prescribed stress and stability buffers. However, the capital relief provided by credit risk transfer on the portion of capital held to cover net credit risk has been cut nearly in half by the new rules.

Exhibit 1: Comparison of capital requirements under 2018 and 2020 proposal

Note: Capital proposals analyzed based on data from Fannie and Freddie as of 9/30/2019. Source: FHFA fact sheet, Table 2, page 11 as numbered.

Fannie Mae and Freddie Mac have traditionally run their businesses in part based on an assumed cost of capital, including opportunities for capital relief. Dramatically lowering the amount of capital relief available from credit risk transfer—in particular through issuance of mezzanine and subordinate securities—changes the economics of these deals.

The disproportionate impact on multifamily K-series

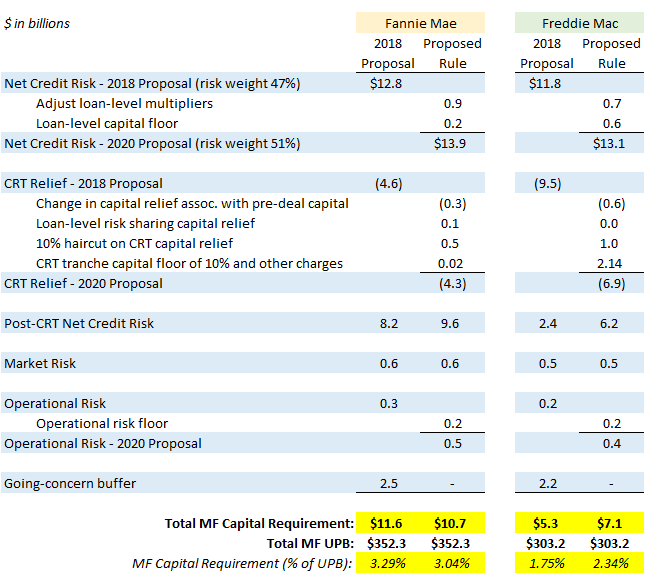

While the multifamily book makes up 10.8% or $656 billion of the combined $6 trillion in adjusted total GSE assets, the projected capital relief provided by multifamily CRT under the 2018 proposal accounted for 34%, or $14.1 billion, of the total CRT impact that reduced required capital by $41.3 billion. A breakdown of the multifamily risk-based capital requirements under the two regimes (Exhibit 2) also shows that Freddie Mac would stand to benefit more from the 2018 rules—getting $9.5 billion of capital relief on their multifamily book due to CRT— while that amount drops to $6.9 billion of relief under that new 2020 proposed rule.

Exhibit 2: Comparison of multifamily risk-based capital requirements

Note: The multifamily capital amounts shown under the 2020 rules do not include any of the additional charges from the three prescribed buffers. Adapted from Tables 29 and 30 of the published proposed rule, pages 242-243 of 424. Source: FHFA, Amherst Pierpont Securities.

The impact of different methods of credit risk transfer

Fannie Mae’s multifamily capital requirements under both proposals are higher than those of Freddie Mac, representing over 3.29% of UPB under the 2018 proposal and falling modestly to 3.04% of UPB under the 2020 rules. This compares to Freddie’s multifamily capital requirements which would be 1.75% of their multifamily UPB under the 2018 proposal, and rising to 2.34% under the new rules.

Fannie Mae uses a loss sharing agreement between themselves and multifamily lenders to accomplish the bulk of their CRT. Generally speaking the lender is responsible for a third of any loan losses and Fannie Mae covers the other two-thirds. Under those agreements, Fannie Mae ends up retaining considerably more risk than Freddie does when they sell the credit risk through K-deal securitization.

K-deals accomplish CRT by including:

- An unrated first loss piece (tranche D, though it’s often called the B-piece) that comprises 7.5% of the collateral or UPB of the deal. This tranche is not part of the public sale to investors and is typically placed with hedge funds, REITs or other sophisticated investors that have deep knowledge and experience with multifamily credit; And,

- Mezzanine C and B class securities which cover the next 2.5% and 4.0% of collateral, respectively, and absorb cumulative losses that exceed 7.5% to 10.0% (class C) and 10.0% to 14.0% (class B) of the UPB.

In such a structure Freddie Mac would be responsible for covering any credit losses that exceeded 14.0% of the collateral UPB, after the first loss (D) and mezzanine classes were presumably exhausted, since all of the remaining issued securities—typically an A1, A2 and AM class—are fully wrapped with the Freddie Mac guarantee.

Freddie’s historical multifamily credit risk in context

Since the multifamily K-series started in 2009, Freddie Mac has not realized any credit losses on their K-deal guarantees. In fact, there has only been $18.84 million in total losses realized by B-piece, or first loss investors, which represents less than 1 bp of total issuance. There have so far been zero credit losses to C or B class investors.

During the worst years of the financial crisis in 2006-2008, Freddie Mac’s realized losses on their multifamily book of business were between 1.50% and 2.10% of outstanding unpaid principal balance. This was before to the launch of the K-series program and arguably under somewhat different multifamily underwriting standards.

Overall Freddie Mac has purchased or guaranteed over $500 billion of multifamily UPB comprising nearly 40,000 loans since 1994. There have been 76 total properties disposed of, with total UPB of $785 million and credit losses of $208 million, for an average loss severity of 26%.

Higher guarantee fees and an expanded AM class

The newly proposed capital requirements tweak a lot of the rules and methods for risk assessment that overall results in higher capital charges and significantly less capital relief for CRT. Freddie Mac appears to have evaluated the impact of the proposed rule and come to the conclusion that the cost of issuing mezzanine debt as part of K-deals is higher than the cost of extending the guarantee and retaining more of the credit risk. In the recent K-108 deal, the guarantee fee was 30 bp, up from the usual 20 bp, and the collateral that used to comprise the B and C classes was rolled into an expanded AM class. The upside is that agency CMBS investors can pick up roughly 5 bp additional yield over the A2s by moving into the AM class for a modest increase of 0.1 years in WAL. The downside is that the AM class is about 11% of a deal compared to the benchmark A2 class which is 75%. The lower liquidity of the AMs relative to the A2s is better suited for buy and hold investors like banks and insurance companies.

The proposed rule has been published in the Federal Register and has entered the 60-day comment period. For the time being, the new normal for K-deals is no mezzanine debt. For investors, it’s time to take a harder look at AMs.

Note: This piece has been expanded from its original version, published 6/12/2020, to include previously published information on Freddie’s initial decision to pass on mezzanine issuance in mid-April of 2020 due to volatility in the market.