Uncategorized

Track record, size, loan quality and liquidity mattered in 2019

admin | January 31, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors.

CLO managers’ record of excess return on their loan portfolios going into last year helped predict their performance in 2019, but other things mattered, too. Bigger operations, stronger loan collateral and portfolio liquidity also helped separate the winners from the pack. With the average leveraged loan trading over the widest range since 2015 and 2016, last year offered the latest test of managers’ ability to navigate changing markets.

A good pedigree helped

Managers with a strong record of excess return going into 2019 generally showed good results during 2019. But measuring track records is a subtle business. Amherst Pierpont measures total returns from price and cash flow for every leveraged loan portfolio backing any active or retired CLO. The analysis kicks out a measure of market sensitivity, or beta, for each deal and each manager and a measure of average excess return, or alpha. Alpha gets refined into an information ratio, a traditional gold standard for measuring the stability of excess returns.

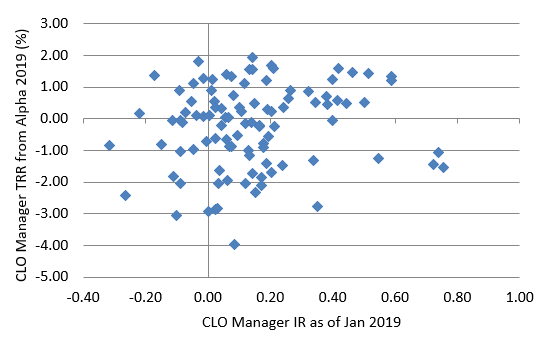

Managers with high information ratios heading into 2019 generally delivered higher alpha in 2019, although results varied significantly even for managers with the same information ratio at the start of the year (Exhibit 1). For managers heading into 2019 with an information ratio of 0.0, for instance, or a track record of no average excess return, the amount of total return in 2019 coming from alpha varied from roughly 1% to -3%. For managers starting 2019 with an information ratio of 0.45 or higher, total return in 2019 from alpha ranged from 1.47% to -1.54%.

Exhibit 1: High information ratio going into 2019 helped predict high alpha

Note: Information ratio as of 12/31/18 and total return from alpha from January through December 2019. Both measures available for 99 CLO managers. Source: Amherst Pierpont Securities

Other things mattered

To better understand other factors that might have created the differences in manager alpha last year, Amherst Pierpont looked at potential contributions from a few sources:

- Manager size. CLO managers probably have an optimal size: large enough to afford an analyst staff able to cover all investable credits in the leveraged loan market but not so large that the portfolio converges toward the index.

- Loan collateral. Weighted average rating factor, weighted average spread and diversity score all usually govern managers’ allowable set of investments, so it seems reasonable that they might affect potential returns. Loan price also matters, with lower prices often limiting flexibility to trade.

- Portfolio liquidity. More liquid portfolios, or ones with a higher weighted average bid depth, should have more flexibility to rebalance a portfolio to reflect changing views of the market.

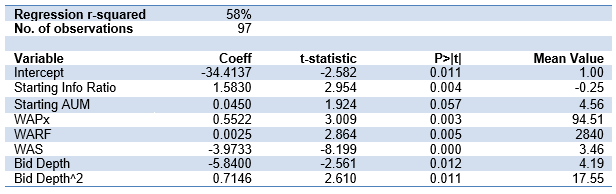

A simple model considering information ratio along with all of these other factors finds that, except for diversity score, all had significant influence on CLO manager alpha in 2019 (Exhibit 2). The model explains more than half the variability in 2019 manager alpha. A couple of observations:

- For every 1 bp rise in information ratio at the start of 2019, manager 2019 alpha tended to end 2019 up 1.583 bp

- For every $1 billion in additional AUM, manager alpha tended to end 2019 up 4.5 bp

- For every $1 higher in weighted average portfolio loan price at the start of 2019, manager alpha ended higher by 55 bp

- For every 100 points higher in weighted average rating factor, alpha came in 25 bp higher.

- For every 10 bp in additional weighted average spread at the start of 2019, alpha end lower by 39.7 bp

- For every additional point of bid depth, alpha came in higher by 86.3 bp

- Diversity score had no significant influence

Exhibit 2: Alpha in 2019 turned on prior track record, size, collateral and liquidity

Note: WAS and bid depth showed a correlation of 0.72. To address the multicollinearity, the analysis first regressed manager 2019 alpha against all variables except bid depth. The analysis then regressed residuals from the first regression on bid depth and bid depth squared to capture nonlinearities. Source: Amherst Pierpont Securities.

Lessons learned

The recipe for good performance in 2019 started with a good prior track record of delivering excess returns. It also included sufficient organizational size, loans with lower spread despite a higher rating factor and good liquidity. The contribution of organizational size to performance is probably more complicated, than a simple linear rise in alpha with AUM, however. A number of managers with average or lower AUM also performed well in 2019, and informally these often seem to be affiliates of larger platforms with a focus on leveraged credit. AUM in leveraged credit across a manager’s platform may be a better measure of organization capacity than AUM in CLOs alone.

The lesson here seems to be that volatile markets reward managers able to monitor quickly shifting credits and then trade on informed views. The manager needed enough liquidity to express those views. In earlier markets, portfolios with higher risk and less liquidity showed good alpha as carry compounded to their advantage. In 2019, however, the receipt for alpha changed.