Uncategorized

A look at pockets of fundamental credit risk in CRT

admin | March 27, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors.

Investors in GSE Credit Risk Transfer bonds, while still in the middle of a volatile market, have started thinking about potential fundamental credit risks. The recently announced GSE forbearance policies and the long-term risk to the economy posed by COVID-19 loom large. As a starting point, there are targeted pockets of risk. Some deals have relatively large concentrations of loans in areas hardest hit by the outbreak where near-term economic disruption may have an outsized impact on the borrowers’ ability to pay. Others have concentrations of loans with high debt-to-income, where unemployment could hurt borrowers’ ability to pay.

Analyzing concentrated geographic risk

CRT investors have seen the effect of concentrated geographic risk before. Hurricanes, floods and wildfires have posed risk to CRT investors over the years. And given the relatively small slices of risk transferred through these deals, small concentrations of risk can still have an outsized impact on performance. To date, concentrated geographic risk has had minimal impact on pool performance as areas hit by natural disasters have largely exhibited ‘V-shaped’ recoveries with relatively minimal economic disruption. However, the large-scale business disruption caused by the virus will in all likelihood cause a thicker tail of delinquencies and potentially defaults, increasing the magnitude of concentrated geographic risk in these deals.

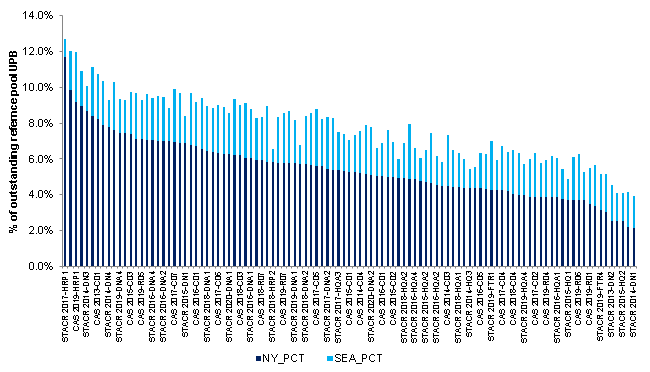

New York City continues to the epicenter of the virus for the country as the number of cases in the area continues to rise and shelter-in-place orders shut down all non-essential business. Seattle has been hit hard as well by illness and business disruption. Looking across the universe of CRT issuance, early vintage fixed-severity and later vintage deals backed by HARP collateral have the largest concentrations of loans in the New York City and Seattle MSAs (Exhibit 1).

High concentrations of New York and Seattle loans in fixed-severity transactions may be particularly problematic. Under current GSE guidance, however, servicers can extend forbearance for an initial six months once Quality Right Party Contact (QRPC) has been established with the borrower, and can potentially be extended an additional six months. In fixed severity CRT transactions, once a borrower goes more than 180 days delinquent, the loan is removed from the pool and assigned a fixed severity based on the total amount of cumulative credit events. And while this unintended consequence of potential loss associated with loans that may never default has been recognized by the enterprises, any change to the current treatment has to be approved by FHFA. Currently there is uncertainty around any potential resolution of this issue but the enterprises are currently exploring options with FHFA to resolve this issue.

If forbearance ultimately yields a credit event, then fixed-severity deals with large exposure to forbearance in affected areas could see greater losses. Despite having high concentrations of New York loans and Seattle loans, CRT deals backed by HARP collateral may fare better as these are actual-loss deals where temporary hardship forbearance, or even term extensions as a result of that forbearance, would not generate a loss to CRT bondholders. Additionally, the HARP deals with the highest concentrations of New York and Seattle loans, STACR 2017-HRP1 and CAS 2019-HRP1 have low mark-to-market LTVs of 59 and 43 respectively. While average LTVs on these deals are low, higher LTV loans in these MSAs and deals would likely be at greater risk of default.

Exhibit 1: New York and Seattle loans concentrations across CRT

Source: Amherst Pierpont, Fannie Mae, Freddie Mac

Analyzing high DTI exposures

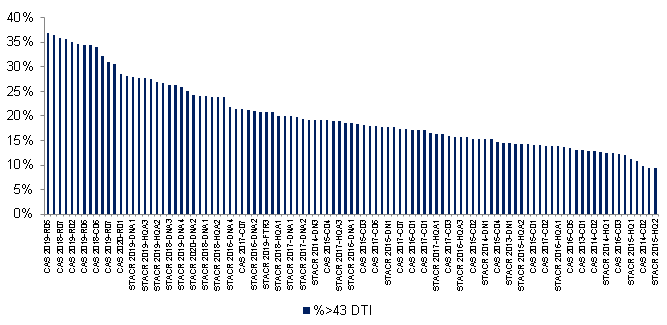

Another potential stress point in CRT fundamentals are deals with large concentrations of loans with high debt-to-income ratios. A disruption to borrowers’ income would drive this ratio higher potentially affecting their ability to make scheduled payments. As a result of the ‘QM patch’ and changes to underwriting standards on high DTI loans made in 2018, later vintage CRT deals can often have large concentrations of high DTI loans as those loans became a large component of the enterprises gross issuance. Conversely, earlier vintage deals have significantly smaller populations of those loans. (Exhibit 2)

Exhibit 2: High DTI loans make up close to 40% of collateral in late vintage CRT

Source, Amherst Pierpont, Fannie Mae, Freddie Mac

Given the increased debt burden associated with high DTI loans, these borrowers may be more likely candidates for permanent modifications at the end of their forbearance periods. In fact, DTI ratios were, the primary driver of modifications in HAMP Tier 1 modifications where rate, term and balance modifications were employed to get a borrower to a target 31 DTI. If a similar methodology were put in place today, higher DTI loans would in all likelihood see a greater incidence of modification.

Depending on the type of modification, CRT investors may be exposed to losses as a result of those modifications. Term modifications will not cause any losses to CRT investors, but rate and balance modifications would. Rate modifications would flow through to investors as monthly principal losses generated from the difference in the loan’s initial and modified note rate. Balance modifications in the form of permanent principal forbearance would be passed through as a principal loss to the deal in the amount of the forborne principal if the loan ultimately goes into default and the forbearance is unrecoverable. Any lost interest on the non-performing balance will be passed through to the trust as a monthly principal loss as well. STACR CRT may also have unique exposure to permanent modifications in that the balance of loans used to evaluate whether a deal is passing its delinquency test trigger that allows the transaction from receiving unscheduled, and in later vintage deals, scheduled principal. For the purpose of the delinquency trigger, stressed loans include loans that are more than 60 days past due, in bankruptcy, foreclosure, REO or have been modified in the past 12 months. Given a high incidence of modifications, STACR deals may have a higher risk of being locked out than comparable CAS deals that do not use modified loans in their delinquency trigger calculations.