By the Numbers

An aging supply of CLOs builds up in the warehouse

Caroline Chen | April 29, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors.

Warehouse financing for the CLO market continues to signal that issuance could cool off quickly later this year, although a healthy supply of deals is still in the pipeline. The number of outstanding warehouse lines has bounced up and down since January but still stands only a bit below last year’s peak. The increasing average age of outstanding lines nevertheless suggests that once the current pipeline clears through the back half of 2022, issuance should drop sharply.

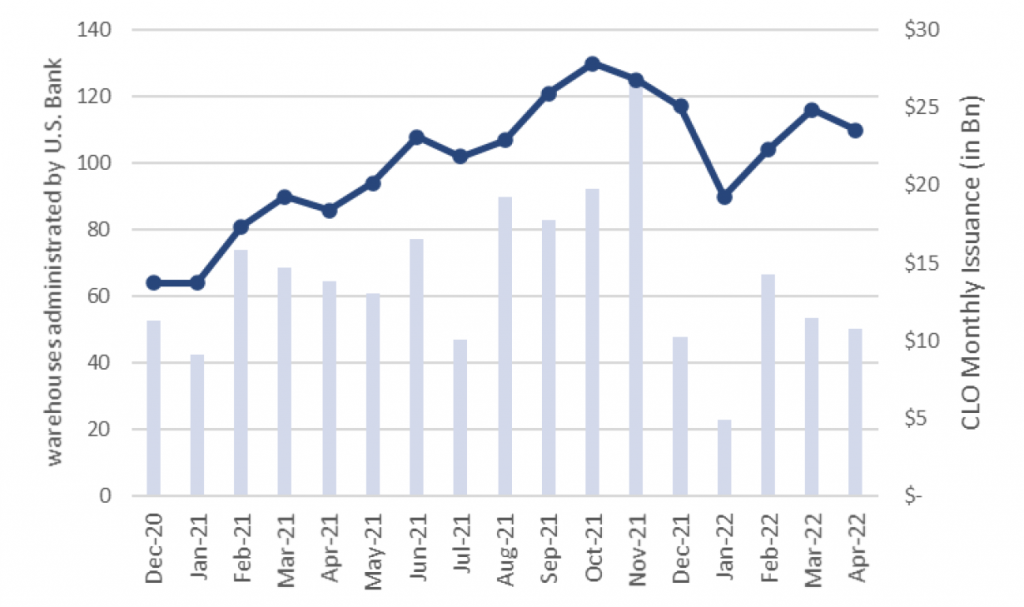

US Bank, the largest CLO trustee, reported in April 110 CLO warehouses under administration (Exhibit 1). US Bank historically has a 52% to 54% trustee market share, implying total open warehouses today of between 200 and 210. That compares to peak warehouses under US Bank administration in October last year of 130, implying more than 250 lines open across the market then. The number of lines administered by US Bank dropped sharply into January, presumably reflecting deals going to market ahead of the deadline for issuing LIBOR-indexed debt. But the number of administered lines has since rebounded. The rebound might suggest a repeat of last year’s market, but something else is going on.

Exhibit 1. The ups and downs of outstanding CLO warehouse lines

Note: The number of warehouses open reflect only those administered by US Bank.

Source: U.S. Bank, S&P LCD

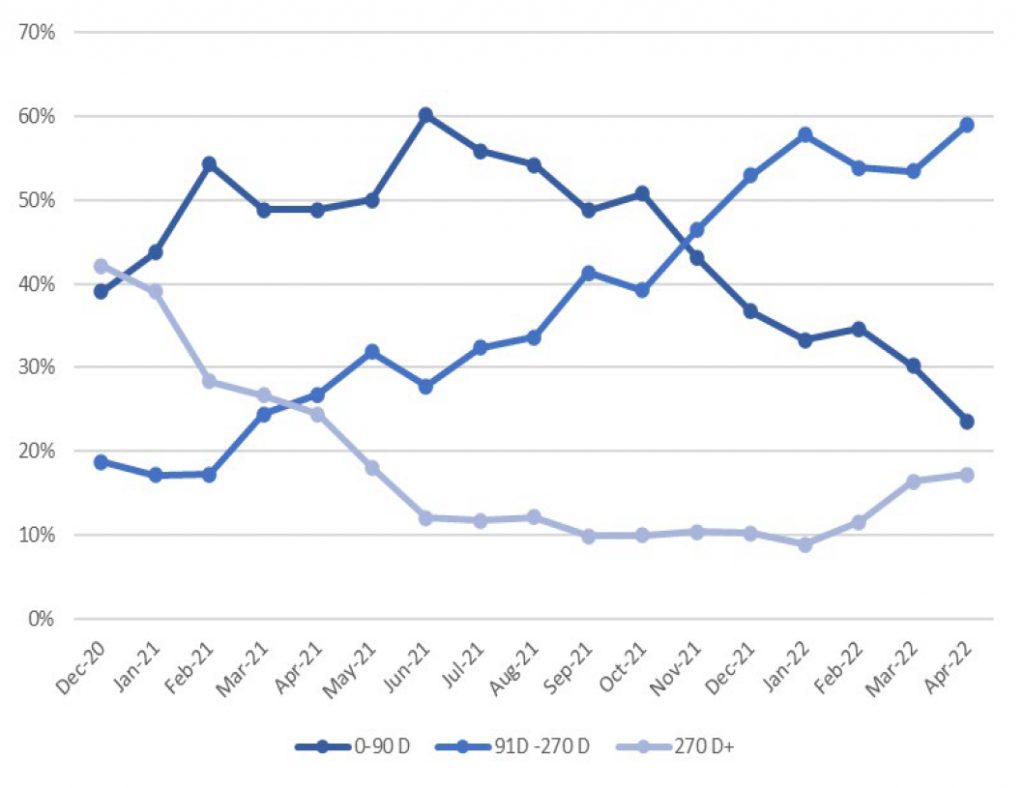

A rise in number of outstanding warehouse lines clearly reflects more lines opening than closing—usually closing after issuing a CLO. Last year, the surge at least partly reflected a backlog of deals waiting for rating agencies and other parties to get through the required work. The number of warehouses aged three months or shorter (0-90D) has declined from 60% in June last year to 24% lately (Exhibit 2). In contrast, the share of warehouses aged in between three months and nine months (91D – 270D) has kept trending up. And the share of warehouses aged nine months (270D+) or more has increased from 9% to 17% this year.

Exhibit 2. The average age of outstanding warehouse lines is rising

Note: the data reflect only warehouse lines administered by US Bank.

Source: U.S. Bank.

A few possibilities could explain the age extension in CLO warehouses:

- After fast growth last year, warehouse lenders may be playing defense in the wake of market volatility

- Widening spreads on CLO debt and the relatively steadier pricing on leveraged loans may have soured some CLO equity investors and managers on the economics of new deals and reduced demand to borrow

- Some managers have chosen lately to print-and-sprint—pricing a deal without a portfolio in the warehouse and aggregating loans afterwards, reducing demand for warehouse financing, or

- Favorable warehouse economics coupled with rising funding costs in the capital markets may have pushed CLO managers to simply wait for a better issuance window to open

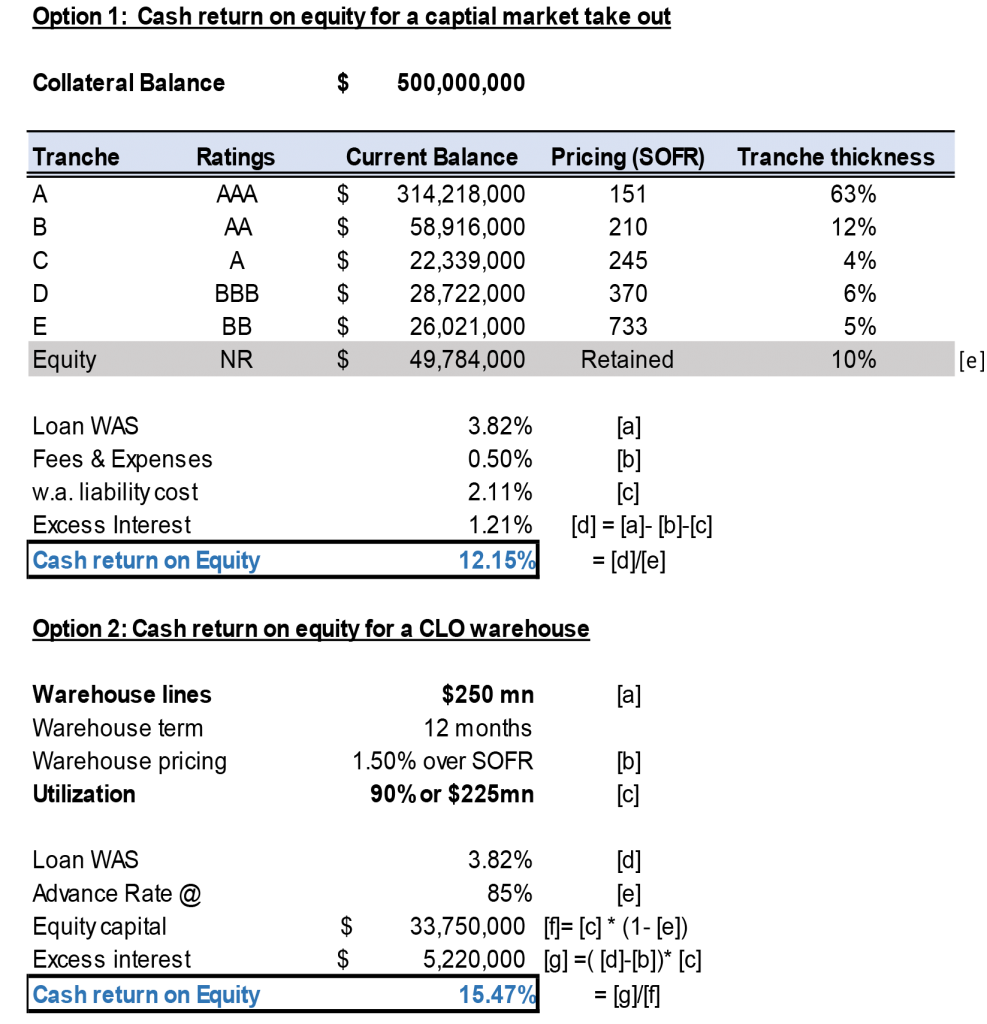

Of these possible explanations, the appeal of warehouse financing over capital markets for now is clear. The funding cost for a new issue BSL CLO has increased from an average of 180 bp in the beginning of this year to 210 bp for some recently priced deals. While CLO warehouses are typically lower levered than CLO deals—5x to 7x leverage in warehouse compared to 9x to 10x leverage through a CLO—an average of low- to mid-100 bp pricing in warehouses offer better economics to most CLO managers. A hypothetical example suggests warehouse financing could offer better cash flow return on equity (Exhibit 3). Of course, warehouse facilities are heavily negotiated between lenders and managers, and the economic impact on equity will be very sensitive to the advance rate, pricing, and fees inputs.

Exhibit 3. Cash-on-cash return on equity may be better for now in a warehouse

Source: Amherst Pierpont Securities estimates

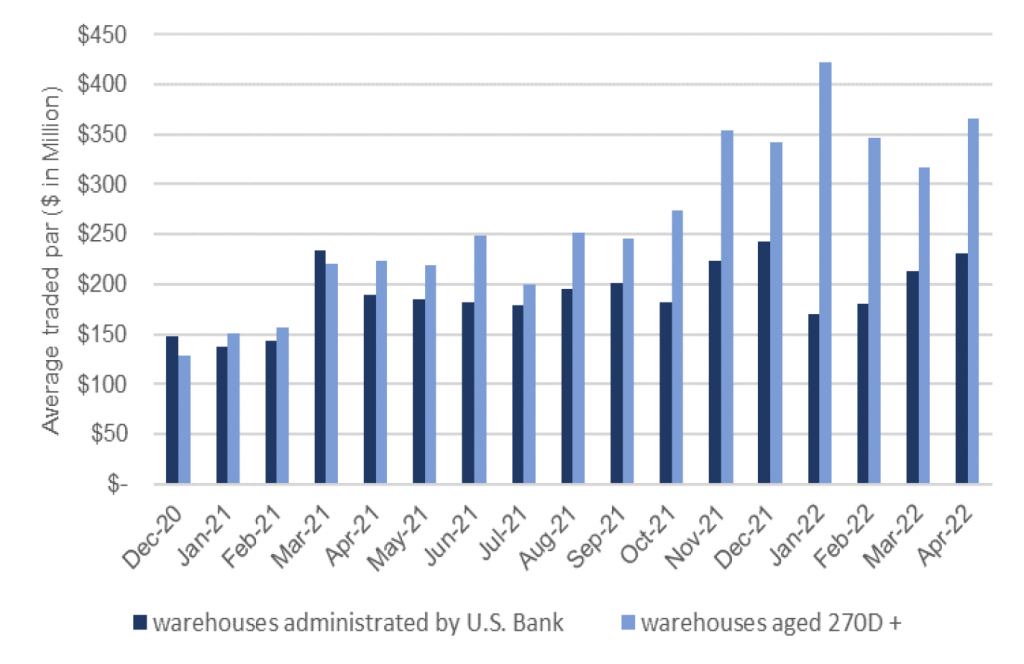

In addition to age extension, warehouse traded par, the aggregate dollar amount of loans in warehouses, also points to a current backlog in CLO warehouses. The average traded par in warehouses aged nine months or older has been much higher than the average traded par in all warehouses under US Bank’s administration (Exhibit 4).

Exhibit 4. Older warehouses have built up steadily larger balances

Note: the data reflect only warehouse lines administered by US Bank.

Source: U.S. Bank

While the current market seems to be discouraging new warehouses, the current backlog needs to be cleared. It is very rare for warehouse lenders to ask CLO managers to liquidate their loan portfolio. Instead, lenders can make the warehouse line to amortize and, in this case, the traded par in warehouse will be reduced accordingly. Another viable solution is to negotiate for an extension. Warehouse lenders can ask CLO managers to post new collateral or simply reduce the advance rate in the warehouse line. Either way, the economics for CLO managers to stay in warehouse will be more expensive, therefore, incentivize managers to execute a capital market take out. That could give equity investors significant leverage in negotiating better terms, lower fees, better pricing or all of the above.

CLO equity and debt investors look like they have an important opportunity ahead. With warehouse balances relatively high but getting older by the day, the pressure to issue should build into July. The average term of a warehouse is 12 months but can be as short as six months. In a very few cases, lenders offer evergreen facilities. The leading edge of warehouses now 90 days to 270 days old starts to bump up against maturity in mid-summer. There may be room to negotiate, but it is not infinite. The back half of this year could see a bit of the CLO market equivalent of a shotgun wedding—issuance under pressure. That creates the potential opportunity. Investors should sharpen their pencils. The low level of new warehouses suggests that after the late 2022 supply, primary issuance will drop significantly.