The Long and Short

Credit Suisse charts a path to recovery

Dan Bruzzo, CFA | October 28, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Investors seem well-compensated at current spread levels for the ongoing risks of Credit Suisse (CS: Baa2/BBB) debt. And while the road ahead may present challenges, newer management seems well attuned to the steps needed to restore investor confidence and address operational weaknesses. Holders of CS notes with 4- to 5-year maturities seem particularly well positioned for further spread tightening relative to the rest of the EU Yankee bank segment. The measures launched this week may not be the final say in turning around CS, but they are the most substantial to date and demonstrate a commitment to revitalizing core businesses, including wealth management and traditional Swiss banking. At a minimum, the capital raise buys management time to work out additional strategies for the long run.

CS has been undergoing a crisis of confidence over the past several months, which is a situation the market has not really seen since the peaks of the EU sovereign debt crisis in 2011 or, using a more recent example, the loss of confidence in Deutsche Bank that followed several years later. In conjunction with third quarter earnings results, the bank announced a series of efforts to shore up investor confidence and demonstrate the long-term efficacy of the organization. The latest efforts follow a recent $3 billion public tender offer for outstanding debt, which was also designed to help calm the markets and demonstrate sufficient capital on the balance sheet.

Exhibit 1. Credit Suisse 5-yr CDS spreads vs the Markit iTraxx Europe Senior Financial CDS Index:

Source: Bloomberg LP, Markit iTraxx Europe Senior Financial index

Credit Suisse announced a $4.1 billion equity capital raise through a rights offering and share sale in conjunction with the bank’s third quarter results, confirming what the market has broadly been speculating over the past several months. A substantial $1.5 billion of the capital will be provided by Saudi National Bank (SNB), which will hold a 9.9% stake in CS, making it the second largest shareholder. Shareholders not surprisingly reacted negatively to the news as the threat of dilution has weighed heavily on valuation over the past several months. CS shares declined as much as 17% in the immediate follow-up to the announcement. Cash bond spreads were a little more undecided, with the benchmark 10-year notes trading several basis points wider than the prior day’s close, but still much improved from the recent bouts of fear-related selling throughout much of October.

CS management has also committed to a headcount reduction of 9,000 over the next three years, in an effort to reduce costs by 15% (total headcount reduction 17%). The bank will begin with a first cut of 2,700 in the fourth quarter of this year. Management estimates that the cost of the restructuring, including the headcount reduction will be approximately $2.9 billion over the next two years.

The bank is also restructuring its investment bank. It will set up an independent entity under the CS First Boston header, housing its capital markets and advisory and leveraged finance businesses and maintain a majority stake in the new entity. CS has a commitment for a $500 million capital injection from an independent investor to help facilitate the transaction. As had been previously indicated, CS is also working out a deal to sell the majority of its securitized products group to vehicles managed by Apollo Global Management and Pacific Investment Management Company (Pimco).

Management is also putting some of its riskier assets and nonessential businesses into a new unit, dubbed a “capital release unit,” that is intended to be eventually sold or wound down. The so-called “bad bank” will include its prime services unit, EM lending, and select European and capital markets businesses.

CS reported a net loss of roughly $4.1 billion in the third quarter, due in part to costs related to the restructuring, the impairment of deferred tax assets, as well as several hundred-million-dollar settlements in various litigation lawsuits.

CS is Switzerland’s second largest banking institution behind UBS with approximately $711 billion in total assets and $377 billion in total deposits. While senior unsecured holding company debt issued by CS is designed as loss absorbing capital under Swiss banking laws, we also believe the bank still benefits from significant implicit government support, and that the state would likely step in to help avoid a stressed re-capitalization of the institution by any means necessary.

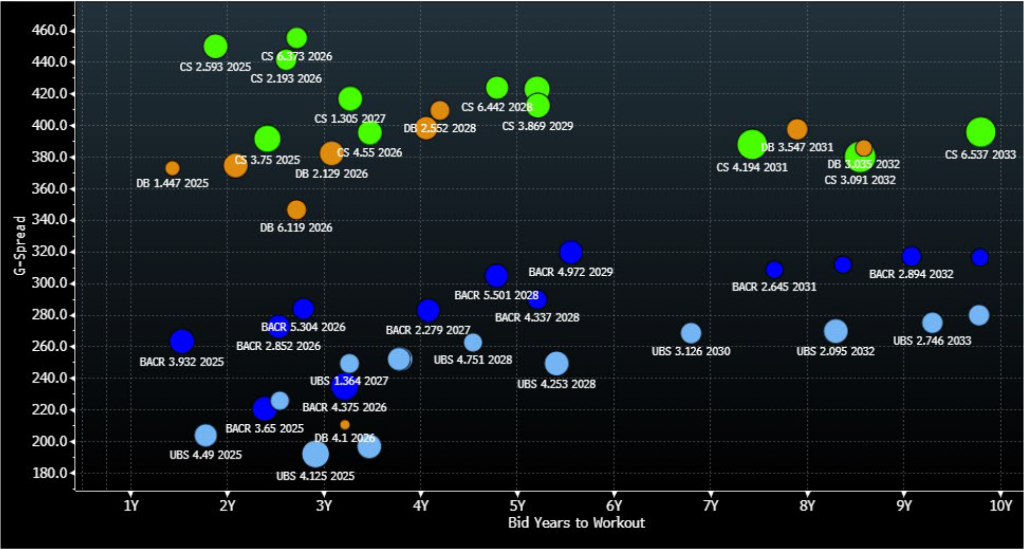

Exhibit 2. Yankee Bank spread curves – CS vs Big EU bank peers

Source: Bloomberg LP/TRACE G-spread indications

CS Cash Bond Markets (APS):

CS BENCHMARK 10YR – CS 6.537 8/33

10/27/22 ~418/413 indication

PRIOR CLOSE: ~400/395

10/3/22 WIDE +505

SEPT 22: +355

Front-End (10/27/22):

CS 1.25 26 310/300

CS 5 27 297/292

CS 4.282 28 420/400