Uncategorized

Blurred lines

admin | December 13, 2019

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors.

The theme in mortgage credit for 2020 may take a page from one-hit wonder Robin Thicke as Blurred Lines describes the competition for loans between the government-sponsored enterprises and private capital. Higher conforming loan balances potentially expand the enterprise footprint, but policymakers have good reason to let some non-core credit flow into private hands, boosting growth in private MBS. The competition could spill into credit risk transfers, too, as private issuers appear poised to compete with the GSEs.

A shifting GSE footprint

The Federal Housing Finance Agency caught some investors off guard last month by lifting conforming loan limits by nearly 5.5% for 2020, pushing the national conforming limit to $510,400 and capping loans in high cost areas to $765,600. The increase, mandated by the Housing and Economic Recovery Act of 2008, seems incongruous with FHFA Director Calabria’s intent to shrink the sizes of the enterprises. However, the move may give the enterprises room to grow volume in certain types of loans while shrinking others.

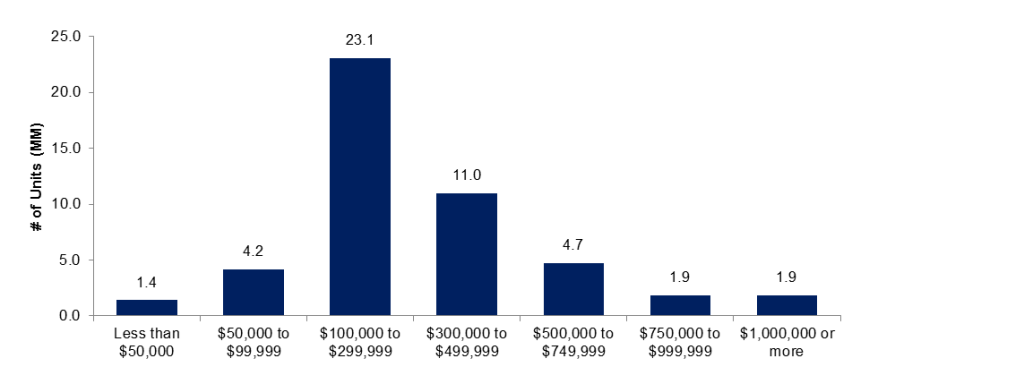

Based on 2018 Census data, slightly more than 60% of total US housing stock, or roughly 48 million units, are mortgaged. Assuming a 25% down payment, the new loan limits would allow the enterprises to guarantee loans on properties worth slightly more than $1 million. Because less than 4% of mortgaged homes in the US are worth more than $1 million, the enterprises’ footprint could cover 96% of homes—assuming the loan met all other enterprise underwriting guidelines. (Exhibit 1)

Exhibit 1: The GSEs may be able to finance more 96% of mortgage balances

Source: US Census Bureau 2018, APS

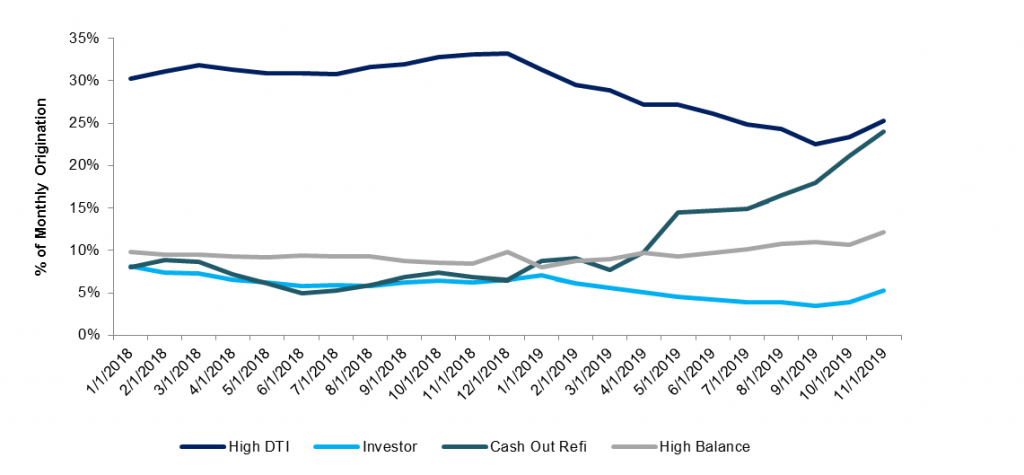

The increases may give Director Calabria room to curb certain non-core loans that currently make up a meaningful amount of enterprise originations the past two years. Given the GSE’s advantage in high DTI lending as a result of the QM patch, loans with greater than a 43% DTI have made up 25% of total volumes so far this year. Because the patch is set to expire in January 2021, the GSEs may be willing to let more high DTI loans flow to the private label market and attempt to capture more core business. It seems plausible that the GSEs may be willing to let other types of non-core loans such as investor loans and cash-out refinancings flow to the private market as well. (Exhibit 2)

Exhibit 2: Monthly share of ‘non-core’ GSE originations across products

Source: Fannie Mae, Freddie Mac, APS

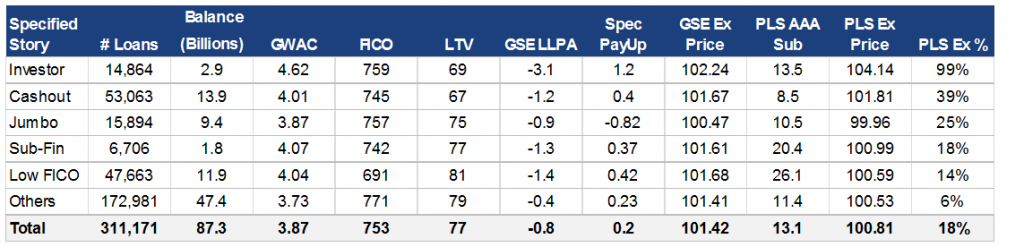

High DTI and agency investor loans may also flow to private MBS for better price execution. High DTI loans with significant compensating credit characteristics may be well suited for private MBS since rating agency subordination levels depend much more on FICO and LTV than DTI—FICO and LTV historically being better predictors of default. Over the past two years, GSE volumes of loans with greater than a 43% DTI have had an average FICO of 740 and an average LTV of 79 with 43 bp of SATO. It seems quite plausible that some subset of this nearly $380 billion in originations may flow to the private market next year. Agency investor loans have been a modest source of post-crisis private label issuance as a handful of issuers have brought deals to market backed by agency eligible investor loans. The flow of agency eligible investor loans into PLS has been primarily driven by onerous GSE Loan Level Pricing Adjustments on investor properties which can be in excess of 4.00% on high LTV investor loans. Based on an analysis of September’s GSE production, almost all investor loans pooled by the GSEs would have had better private label execution. (Exhibit 3)

Exhibit 3: Estimating GSE eligible execution in PLS

Source: Amherst Insight Labs, APS, Fannie Mae, Freddie Mac Analysis assumes subordination levels based on NRSRO criteria, pricing the ‘AAA’ pass through at 1 point behind the applicable spec pool pay up/pay down and subordinate pricing in-line with current prime jumbo execution.

The move to shrink volumes of certain types of loans that the GSEs purchase may be driven by Director Calbria’s eye towards the potential end of conservatorship for Fannie Mae and Freddie Mac. The GSEs recently tightened their requirements for purchasing mortgages to borrowers with greater than a 95 LTV. And per a recent Wall Street Journal article the move was motivated by the regulator’s desire to de-risk the guarantee books of the GSEs in an effort to attract potential private capital. “Some of this is really a reflection of the increased emphasis and focus on: let’s do what we need to do to get out of conservatorship,” said Calabria.

A new source of mortgage credit risk

JP Morgan broke ground earlier this year, taking a page from the GSEs playbook in the form of a synthetic credit risk transfer on roughly $750 million of portfolio whole loans. The transaction potentially looks poised to be the next little big thing but there are some practical headwinds to the structure being widely applicable to commercial banks of all shapes and sizes. Given the synthetic nature of the transaction, the payments of principal and interest are not collateralized by the reference pool of loans but rather are unsecured corporate obligations of the issuer, making the deal a hybrid of mortgage credit and unsecured corporate risk. As a result, the structure is likely applicable for large, highly rated banks where the incremental risk premium necessary to compensate investors for the corporate credit risk does not outweigh the benefit to regulatory and economic capital associated with the transaction.

However, a change to certain arcane securitization rules could open the door to a much more meaningful amount of mortgage credit risk transfer from commercial banks. In the wake of the financial crisis, certain changes to accounting rules for securitization triggered a wave of pre-crisis deals to be consolidated back on to bank balance sheets. In response to these changes, the FDIC created a framework for bank securitization, the FDIC Securitization Safe Harbor Rule. The rule is in no way linked to the Qualified Mortgage safe harbor designation, but rather sets forth a framework which allows banks to engage in securitizations while protecting investors. Banks under the framework can retain significant economic interests in the deal, service the loans and account for the deal as a secured financing while still affording investors the same protections available under a bankruptcy-remote true sale.

Under the current rule, issuers have to provide the same disclosures and reporting required for a public securitization under Regulation AB II. A proposal issued in July would ease this reporting requirement. From a practical standpoint, most banks do not have the infrastructure for this level of reporting, and easing the rule could pave the way from more banks to transfer credit risk through a traditional cash securitization rather than a synthetic framework. This framework would allow banks to transfer mortgage credit risk without the additional premium associated with their unsecured credit risk – potentially removing a significant deterrent for the majority of banks to transfer credit risk to investors.

Regulators may be looking at ways to level the playing field between the GSEs and commercial banks in the area of risk transfer. In their housing reform plan released in September, the Treasury Department called the incongruity in the capital treatment of securitizations and transfers of mortgage credit risk from the GSEs and commercial banks “a potentially unwarranted gap” that “merits scrutiny by the FHFA and the federal banking regulators.”

There are other considerations as well. First is the issue of scale. Given the fact that the slices of credit risk transferred are relatively thin, banks would need significant critical mass to do a deal. This could be problematic for small community banks that do not have requisite scale to issue a deal. However, there are potential solutions to this issue. Certain intermediaries, potentially the Federal Home Loan Bank system could help coordinate securitizations where multiple banks could contribute collateral to the risk transfer deal, creating both scale and potential diversification.

A final consideration and key difference between bank and GSE CRT is that the banks will transfer credit risk but not most of the interest rate risk associated with the loans as they will be retaining the large majority of the structure and associated interest rate risk. With that said, the banks are already owners of that risk and assuming a traditional shifting interest structure where the bank would sell all of the six-pack of subordinate tranches and retain the senior interests, it would reduce their overall interest rate risk on the pool.

While it’s impossible to say with certainty, it appears 2020 is setting up as a year that the private market will finally provide meaningful competition to the GSEs both in the areas of securitization and credit risk transfer.